Survey: Sector optimism tempered by staff shortages

ECAtoday

The latest engineering services sector survey shows that the majority of business owners and decision-makers expect their business performance to improve in the short term towards year-end and beyond. The finding comes despite concerns about economic and recruitment challenges ahead.

The latest findings of the quarterly Building Engineering Business Survey, backed by trade bodies ECA, BESA, SELECT and SNIPEF, revealed that three quarters (75 percent) of engineering services businesses expect to perform better in Q4 2022 than one year ago, in Q4 2021.

Three quarters (74 percent) of respondents also expect their turnover to stay the same or increase by the end of Q4 this year. Almost 4 out of 5 businesses (78 percent) saw their turnover stay the same or increase between April and September (Q2 and Q3) this year, and most seem to expect the trend to continue in the short term.

However, the survey revealed widespread recognition of the challenges ahead, as just over half (51 percent) listed staff shortages as their number one or number two worry for their business. More than half (52 percent) highlighted shortages in electrical skills as a particular concern.

Closely following was overriding concerns about price inflation of materials as there continues to be a global shortage of semi-conductors.

ECA Director of Legal and Business Rob Driscoll said:

“Today’s engineering services landscape is more complex than ever. The major increase in energy prices has significantly increased demand for certain services, but residual concerns remain over material costs for all products requiring electronics.

“Continued labour shortages and growing worries about delivering fixed priced contracts continue to keep business owners up at night. This could indicate a near future where order books appear healthy, but work is delivered at negative margins. Contractors should be cautious in their optimism, as the effects of economic decline in 2023 will take some time to filter through to the engineering services sector and could be felt later on.

“Wise businesses have been using the CLC Product Availability Statements to collaborate and tackle inflation in order to build on long-term sustainable delivery for clients.”

BESA Director of Legal and Commercial Debbie Petford said:

"Our latest survey demonstrates that contractors are facing an unprecedented variety of challenges, but also that they are doing an admirable job of coping with them and turning several into growth opportunities.

"We are all having to tussle with the cost-of-living crisis, but our industry has a big role to play in long-term solutions, particularly in improving energy efficiency and lifecycle performance of buildings. This is clearly reflected in the findings of the survey which point towards significant growth prospects for building engineering firms in the medium to long term.”

The sector continues to deal with challenging payment practices. Seven in 10 survey respondents (70 percent) currently have up to 2.5 percent of their turnover in retentions. Meanwhile, almost 4 out of 5 (78 percent) say commercial client or main contractor work is still being paid for more than 30 days after the job, with some (4 percent) experiencing delays of up to 90 days or more.

The Construction Leadership Council (CLC) in collaboration with NEC recently published guidance to industry on the use of retention clauses under NEC3 and NEC4 Engineering and Construct Contracts (ECC), and sub-contracts.

Steve Bratt, ECA CEO and Chair of the CLC’s Business Models Workstream said:

“The long-term aim is to eliminate the need for retentions altogether. This guidance illustrates that often the need for retentions can be avoided through good contract management and selection of contractors with a good track record of quality work.”

Despite strong confidence in demand, the grand majority (94 percent) of survey respondents said they expect payment behaviour to stay the same or worsen by the end of the year.

174 engineering services businesses responded to the Q3 2022 Building Engineering Business Survey (BEBS), which asked about their business performance in Q3 2022 and their expectations for Q4 2022 and beyond.

The survey was carried out in partnership with industry trade bodies BESA, SELECT, and SNIPEF, who together represent over 6,000 businesses of all sizes across the built environment sector, and is sponsored by Scolmore.

The survey ran from October 24th, 2022, to November 8th, 2022.

ECAtoday

Related Articles

ECA Member becomes founding partner of the Warrington Fund

Government warned to act fast on energy storage

Energy giant to convert coal plant into green energy hub

Data shows £74bn growth in green economy

2024 SPARKS Female Skills Competition launches

JIB Survey of Accidents at Work

NHS Scotland unveils first solar EV charging hub

SEA launches report to support move to energy efficiency

Significant steps towards better skills and competence revealed in CLC report

Latest Building Safety updates from the CLC

BT to repurpose broadband cabinets for EV charging

Electrical fault causes fire at Hampshire housing block

EIC offers free mental health training for apprentices

Recolight responds to WEEE consultation

Ruth Devine awarded MBE

National Grid ESO opens up to batteries

50,000 chargepoint boost for EV drivers

Boost in UK solar needs 500 more electricians per year

ECA Recharges Electrical Skills at the House of Commons

ECAtoday is out now!

Electrical sector feels skills shortage bite

Update on the Energy Savings Opportunity Scheme (ESOS)

ECA applauds Chancellor’s payment reforms for SMEs

ECA's Rob Driscoll discusses sector finances with CN

HSE highlights risks of workplace dust

ECA backs Bill to tackle Li-Ion battery fires

Environment Agency cuts waste red tape

ECA highlights “mixed signals” in King’s speech

National Grid accelerates renewables connections

ECA welcomes new Cabinet Office payment rules

Influential Business Survey opens for Q3

Revolutionary Welsh Housing Quality Standard introduced

Electrical skills timebomb in Eastern England

New laws to speed up EV charging

More support necessary for Greater London to fill green electrical apprentice shortfall

New ECS cards launched for Building Controls sector

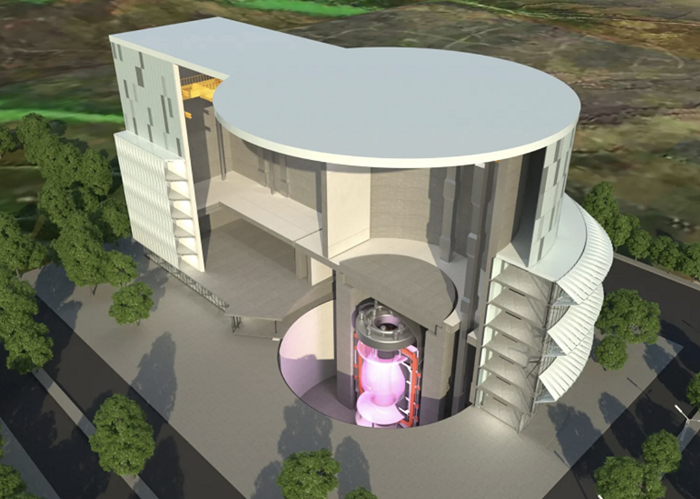

Nuclear mini-reactors on the horizon

Role of local Government in Net Zero 'overlooked'

National Grid plans grid balancing measures for winter

Leading apprentice wins 2023 ECA Edmundson Award

ECA and FSA respond to Building Safety updates

ECA cautions against net zero targets becoming political football

ECA helps launch new industry skills authority

Joint letter calls for action before COP28

New Experienced Worker Assessment routes approved for FESS industry

Women in Security win accolades in London

Volvo to use car batteries in BESS

UK and Ireland sign 'landmark' green agreement

ECA launches country-wide #ProjectNetZero Roadshow

Leeds City Council opens all-electric, all-solar park-and-ride

Scotland to England power cable on the horizon

Government launches UK Business Climate Hub

Firm plans extensive EV training for technicians

JTL promotes newly revised electrical apprenticeship standard

Ovo to pay customers to use off-peak green energy

ECA Member recognised for world-first standard

‘Electrician Plus’ concept launched

New rules to improve fire safety of social housing

Share your views on product safety

Gov't plans to build new power lines twice as fast

Actuate UK calls for clarity on CE and UKCA mark

Welsh electrical firms especially worried about future skills

Building Safety Regulator raises concerns

ICEL Emergency Lighting Conference 2023 set for 14 September

Gov't pilots decarbonisation scheme

ECA warns Gov’t against ‘missing the boat’ following Net Zero report

UK EV gigafactories on the horizon

Research reveals urgent need for Net Zero skills

Influential quarterly Business Survey now open!

Gov't report busts 23 Net Zero myths

SkillELECTRIC 2023 UK Finalists Announced

New low-carbon engine manufacturer set for UK HQ

Put electricians at the heart of the clean energy transition, says ECA

Updated Carbon Reduction Code for the Built Environment

Electrical contractors celebrate honours at ECA Industry Awards 2023

ECA's Gary Parker speaks on LBC Radio

Paul Reeve comments on alternatives to onsite diesel

National Grid seeks contractors for £9.3bn of contracts

NHS to roll out green estates framework

BSI launches Young Professionals Programme

Construction firm warns of supply chain fraud

Government mulls commercial solar plan

Report: Net Zero could provide 700,000+ UK jobs

Impact of labour shortages worsen for engineering services

Nationwide inspection campaign to focus on dust

ECA Member BGEN appoints new CDO

Utilities warning over live cables

Public sector using Common Assessment Standard

Wiring Regulations update: corrigendum published

Industry welcomes new fire and security apprenticeship for Wales

Wiring Regulations corrigendum coming next week

Electrotechnical Apprenticeship sets gold standard for green skills

Three quarters of tradespeople upskilling to go green

ECA Edmundson Apprentice of the Year Award 2023 now open for entries

Influential quarterly Business Survey now open!

Shortlist revealed for 2023 ECA Industry Awards

UK and Netherlands to build world's biggest power line

ECHO-connected alarm handling celebrates 2nd anniversary

UK energy solutions funding competition opens

Product testing overhaul to follow Morrell review

Co2nstructZero Business Champion applications open!

Offsite manufacturing could slash emissions, says report

Skanska trials electric drilling rig

EDA survey shows sector moving towards digital

JTL welcomes listing of apprenticeships on UCAS

Government publishes heat pump roadmap

Funding announced for 53 new electricity and gas network projects

Revised PAS2080 Standard and Guidance launched

BEAMA responds to new energy policies

Powering Up Britain: Gov’t listens to some industry concerns, but continues to overlook skills

ECA Commercial Associate ABB invests in DC microgrids

Last chance to enter the ECA Awards!

Balfour Beatty launches pop-up EV chargers

Electrical Distributors’ Association Annual Awards

£1.8 billion for energy retrofit

New performance framework for construction products

Cabinet Office note to boost public sector CAS specification

Spring Budget: Electrical sector welcomes energy bills U-turn, but warns of skills crisis

Government publishes searchable Building Regulations and Approved Documents

Budget to boost carbon capture and nuclear

Long queues for East of England EV drivers waiting for high-speed public charge points

HS2 seeks ECA Member views

Business Survey: payment and recruitment challenges loom for engineering services in 2023

Welsh Government highlights ECA in Green Skills Action Plan

ECS Annual Review Highlights Raising Standards

SkillELECTRIC 2023 now open for entries

Smart meters in half of British homes

Fast-track planning to be tested on projects

NHS launches £500m framework

1.29GW of battery storage coming to the UK

New Ministry champions holistic approach to decarbonisation

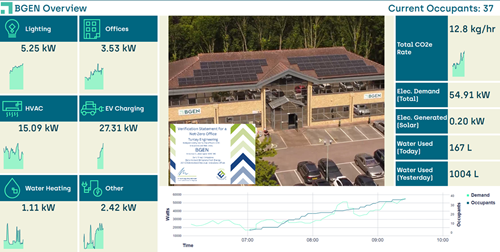

ECA Member BGEN transforms its headquarters into a net zero building

East Midlands EV drivers lose out to Londoners says new evidence

Over £110 million to unlock zero emission flights

NG Bailey opens apprenticeship scheme

Government urged to develop energy storage strategy

UK energy entrepreneurs to receive cash boost

M&E subcontractors sought for £545m of work

Onsite "plug-and-go" 5G networks developed

NAW 2023: Electrical apprenticeships offer best career opportunities

ECA welcomes creation of new Energy & Net Zero Department

Join a £135 million public sector framework

The UK added 800MWh of energy storage in 2022

Construct Zero Business Champions round 13 opens

ECA Commercial Associate delivers millionth EV charger

Industry Accreditation cards to expire in 2024

New Fire Safety Regulations come into effect

Jeremy Vine set for 2023 ECA Industry Awards

ECHO celebrates milestone

ECA Commercial Associate scoops sustainability prize

National Grid seeks contractors for green boost

JIB Apprentice Exchange winner announced

Signify upgrades University of Cambridge's outdoor lighting

MPs call for home insulation drive

Smart meters up by a third in 2022

CLC Construct Zero highlights 2022 success

Renewables generate 40 percent of UK electricity

Recognition for industry colleagues

ECA’s voice heard on SME payment review

UKCA transition extended to 2025

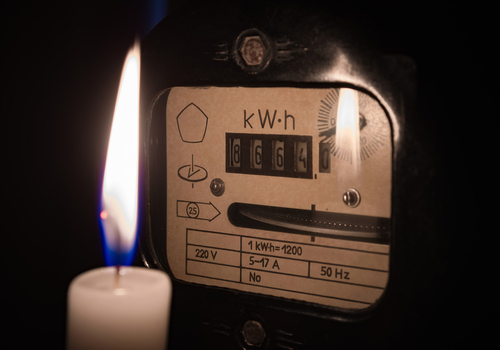

Winter energy crisis: ECA’s advice for managing power cuts

NEC to host free webinar on retentions

2023 ECA Industry Awards now open for entries!

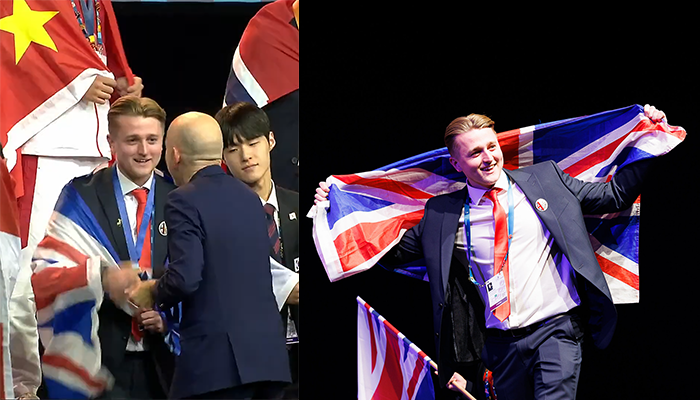

WorldSkills success for young Somerset electrician

CLC Launches Young Ambassadors Recruitment Competition

Survey: what are your barriers to low-carbon work?

Global firms back battery re-use proposals

Waitrose embraces heat pumps

ECA welcomes Hunt’s energy resilience message, but says electricity taxes counterproductive

New Construction Minister announced

New private sector Construction Playbook to boost productivity

UKCA deadline delayed

COP27: “No net zero without skilled workforce” says ECA

COP27: ECA joins voices calling for joined-up policy approach

Cost of living crisis: shoppers turn to second-hand appliances

COP27 begins

Have your say: EV Charging Standards

Appeal for employers to assist with validating T levels

Work continues to update Electrical Apprenticeship in England

NHS Wales seeks contractors for £7m of work

CLC urges CE mark U-turn

CLC support for Energy Bill Relief Scheme

This December: Join the NHS hospital building programme

Shell shuts key hydrogen vehicle sites

SSE launches UK wide EV charging network

CIBSE recognises up-and-coming industry talent

ECA Members: Answer our latest influential sector survey!

ECA reacts to Rishi Sunak’s appointment as PM

ECA ‘seriously concerned’ about political turmoil in Westminster

New festival of electrification

Electricity market reform must promote clean energy, says ECA

WHO issues mental health at work guidelines

National T-Levels Week : Toolkit for Employers

Report: Hydrogen not a “silver bullet” for heating homes

CLC’s latest product availability update

Balfour Beatty boost offshore wind prospects

New Construction minister announced

Kier Highways to offer apprenticeships to prisoners

ECA to host free Amendment 2 webinar on top 10 changes to the Wiring Regulations

World EV Day 2022: New research strengthens case against cutting corners on EV charging safety

How can ECA support you better?

Government launches Net Zero review

Leading apprentice wins 2022 ECA Edmundson Award

Construction Leadership Council announces its new strategy

ECA launches Leading the Charge series

ECA responds to Energy Bill Relief Scheme

Two thirds of Brits have smart home plans

Energy sector demands ‘radical action’ from COP27

ECA mourns passing of Her Majesty Queen Elizabeth II

ECA takes key role on UK Electricity Products Supply Chain Council

ABB smart building scheme boosts Manchester Metropolitan University

Act now to avoid industry crisis, ECA warns Liz Truss

Floating device could provide ‘cheapest’ renewable energy

World’s largest offshore wind farm begins operation

SEA publishes tips to access energy efficiency schemes

Solar panel sales through the roof

Balfour Beatty seeks contractor for £30m of MEP work

Electrical industry reacts to Ofgem price cap rise

UK’s first fusion plant calls for tenders

£20m public EV chargepoint boost

Electricians urged to join fight against tool theft

Common Assessment Standard uptake grows

Cutting-edge vanadium flow battery brought online in Scotland

Scottish factory to build Sahara-Devon cable

ECA Member supports first T Level cohort

ECA’s solution to rising bills could save 70% of UK households £100 a year

Cheshire energy tech factory to hit net zero 8 years early

CIBSE Climate Action Plan highlights impact of building services on net zero

New report highlights net zero skills shortage

First Smart Factory for Formula One

Survey seeks insight into roof ladder use

NE businesses incentivised to go low-carbon

New carbon-negative microgrid in Manchester

SLL Young Lighter 2022 open for entries

BSI launches new competence standards

Scotland to ban fossil fuel boilers

New green heat grants available

ECA Edmundson Apprentice of the Year Award finalists announced

Join the biggest hospital building programme in a generation

More than a million businesses now eligible for Help to Grow

ECS gold card milestone

ESF warns against TikTok heatwave 'hack'

ECA asks: why are electricity prices four times more expensive than gas?

Infographic shows impact of energy transition

HSE guidance for working in heatwaves

Sign up now: HSE Inspectors’ Guide to Electrical Safety

UK electricity market reform to ease pressures

New Construction Minister announced

BPF calls for green tech incentives

CICV and Actuate UK members launch Green Homes Festival

Offshore wind milestone: 11GW of capacity underway

50GW offshore wind target needs £54bn, says National Grid

New Electricity Networks Commissioner appointed

Oxford to become global battery hub

ECHO wins at British Security Awards

Signify calls for accelerated transition to LEDs

Become a Construct Zero Champion!

ECA Members named top apprentice employers

Report: heat pumps critical for high skills, high wage economy

SEA points out gaps in Gov’t Net Zero policy

New CLC statement on product availability

Building Safety Act comes into force

CompEx partners with Trainor to shape the future of e-learning

Wearable device monitors onsite dust exposure

Mark Reynolds confirmed as new CLC Co-Chair

New measure to make UKCA marking easier

Your chance to comment: Code of Practice for Solar PV installations

Respond to the latest People Survey

Offshore jobs to grow to 100,000

HSE shares new guidance on slips and trips

Boosted funding to expand charger network

UK Infrastructure Bank takes shape

CLC survey: PII premiums “disproportionally” affecting SMEs

Firms hunt for the right people to aid bounce back

The Future of Construction – interview with ECA CEO Steve Bratt

ECA responds to government Inquiry into fossil fuels and energy security

Government invests over £31mn to cut carbon

CLC: inflation overtakes product availability concerns

Watch now: ECA Learning Zone with Ensign

Simpler procurement rules on the horizon for SMEs

£200m battery centre planned for West Mids

MPs call for fewer demolitions to cut carbon

Construction giant ISG joins CAS

CIBSE and BEIS new heat pump guidance

Northumbria Police connects to ECHO

Contractors wanted for Midland Mainline electrification

ECA urges industry to prepare for heat pumps demand

Help to Grow your SME with BEIS

5MW solar farm set for Buckinghamshire

BEAMA launches specialist tool for heating installers

ESF petition to stop sale of dangerous goods

Working Group 2 Competence Report published

Industry leader Steve Murray becomes ECA President

EIC promotes Mental health First Aider Training

Guidance for drivers to cut fuel costs

First diesel-free construction site for HS2

Survey shows two thirds of motorists want to switch to EV

ECA welcomes Queen’s Speech promises with high expectations for skills, safety and Net Zero

Council fined £50,000 for employee HAVS

Prestigious Apprentice Awards return!

Business Survey opens!

BEAMA publishes new AFDD FAQ sheet

ECA calls for stronger competency requirements in Building Safety Act

Local Elections 2022: ECA calls for better local EV charge point policy

Heat pumps now cheaper to run than gas boilers

ABB Formula E unveils next-gen electric racer

Building Safety Bill receives Royal Assent

Green skills made top priority in new law

Bedford landlord fined for fire safety breaches

NHP Supplier Guide published

Webinar: How to avoid ‘Smash and Grab Adjudication’ with Rob Driscoll and Payapps

Zero emission flights on the horizon

CLC warns of product prices rise between 10-20%

IfATE launches apprentice panel competition

CSCS Smart Check app launched

Catch up with the EIC mental health podcast

Join this week's CPD webinar, with Detector Testers!

Contractor and subcontractor fined after cable strike

Driving for Better Business launches fleet risk podcast

ECAtoday Spring 2022 is out now!

ECA's #Project18 off to a flying start!

ECA responds to Energy Security Strategy

More are now eligible for Level 3 funding

IPCC publishes ‘final warning’ climate report

Changes to PPE Regulations start today

Real-time onsite silica dust detector launched

New app to simplify skills card checks

Open ECX launch new EDI invoicing platform

Common Assessment Standard Updated

Contracts push back on 'greenwash'

ECA launches UK-wide Amendment 2 Roadshow

CLC publishes Guidance Note for Ukraine crisis

HS2 signs up to support CO2nstruct Zero

ECA welcomes new EV strategy, but warns of potential dangers from low standards

ECA pays tribute to Paul McNaughton

Green light for Domestic Electrician Apprenticeship

Gov’t answers ECA’s call for 0% VAT on renewables

ECA joins calls for unprecedented action on energy prices in Spring Budget

Join the ECA Learning Zone with Revizto!

Gov’t extends plug-in van and truck grants

New hard hats to include MIPS technology

BEAMA launches Net Zero systems report

First new-style pylons installed in UK

Actuate UK and Energy Systems Catapult boost green skills

ECA champions green careers

Sylvania chooses EDATA

IFSEC Global publishes Annual Fire Safety Report

ECA asks Europe to focus on Green Deal

ECS highlights crucial upskilling role

SkillELECTRIC 2022 open for entries

New Solar Energy UK report on attitudes to solar

CO2nstruct Zero continues to grow

HSE issues safety notice on UPS

What’s new with ElectricalOM? Sign up and find out!

UK’s largest gas-free homes scheme breaks ground

Are you up to date with ECAtoday?

ECAtoday is the official online magazine of ECA and reaches thousands of people within the electrotechnical and engineering services industry.

Copyright © 2024 Electrical Contractors Association Ltd

.png?width=1000&height=606&ext=.png)

.jpg?width=500&height=335&ext=.jpg)

.jpg?width=750&height=485&ext=.jpg)

.jpg?width=1024&height=683&ext=.jpg)

.jpg?width=500&height=402&ext=.jpg)

.jpg?width=3508&height=2481&ext=.jpg)

.jpg?width=500&height=535&ext=.jpg)

.jpg?width=500&height=350&ext=.jpg)