Increasing Pay Pressures in Engineering Services

Catherine Watt

Head of Employee Relations

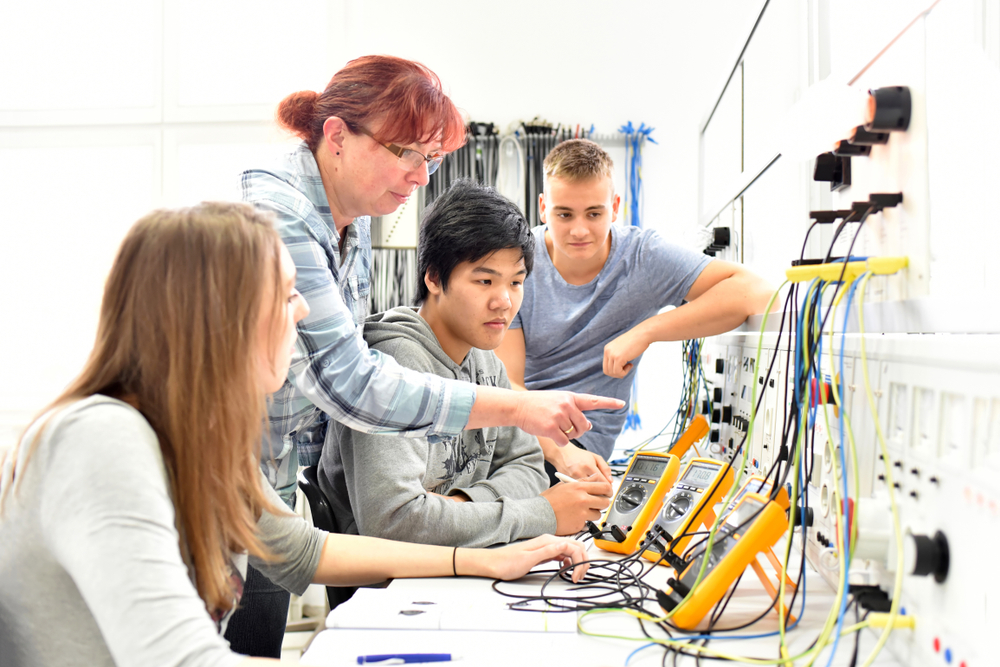

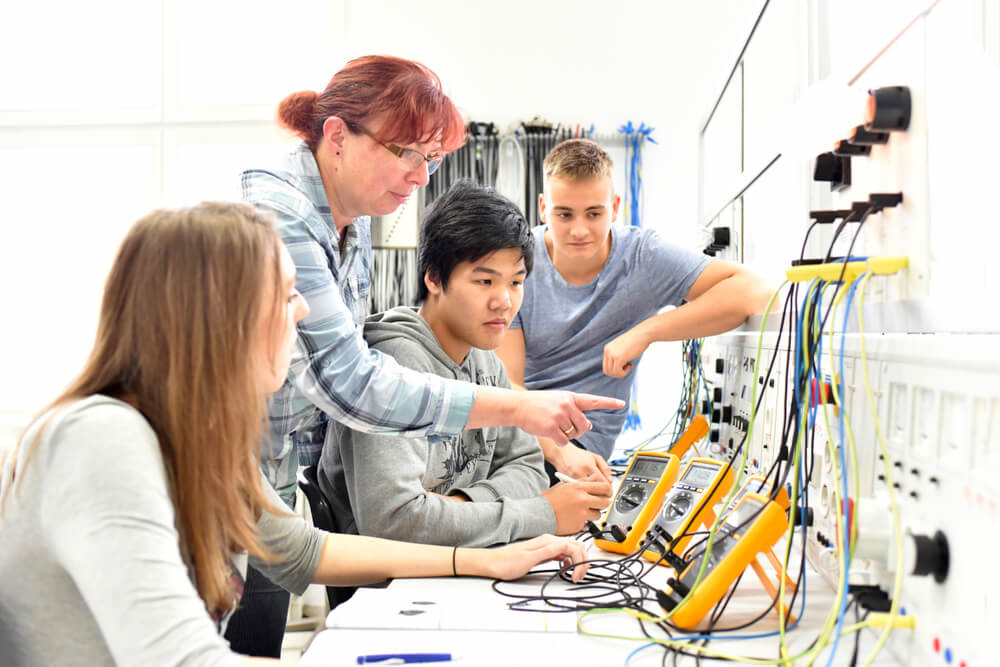

In a highly competitive market, recruiting and retaining a skilled workforce presents ongoing challenges to employers in the sector. One key determinant of success is to ensure that pay and benefits are attractive and in line with the market.

ECA has recently completed the third edition of its Large Employers’ Key Staff Salary and Benefits Survey report. This provides valuable insights into the current pay market.

The survey presents important information on trends in labour turnover (the average number of people leaving employment for all reasons as a percentage of the average number of people employed).

Survey respondents are generally predicting higher pay awards in 2022 than in the past few years

Among survey respondents, labour turnover increased significantly from 9.9% in Spring 2021 to 15.3% in October 2021, confirming anecdotal feedback that labour market churn has increased markedly since early summer.

One response to drive down employee turnover in a buoyant labour market is to ensure that pay rates remain competitive. Across all the surveyed jobs, pay increased by an average of 1.5% between 2019 and 2021, with the largest increases among Senior Commercial Managers, Planners, Estimators and Buyers.

By far the most common pay award for 2021 was 2%, within a broad range of between 1% and 3%. Performance was also an important common factor in determining an individual’s pay increase.

It is also important for organisations to benchmark how their peers are structuring their benefits packages.

Survey respondents are generally predicting higher pay awards in 2022 than in the past few years, with an average prediction of 3%. This compares to a UK whole-economy prediction of 2.5%.

It is also important for organisations to benchmark how their peers are structuring their benefits packages.

The survey concluded that 62% of respondents offer private medical insurance, with 55% offering employee-only cover (i.e., excluding family), although this reduces at higher levels of seniority.

37.5% of employers offer a company car. Compared with 2019, a greater proportion of larger ECA members currently offer both a car or a cash alternative to employees at middle management level through to directors, with the value of the car generally increasing with the seniority of the role. Below the middle management level, a greater proportion offer a purely cash alternative than they did in 2019.

If you have any questions on the above, please contact the ECA Employee Relations Advisory Service at employeerelations@eca.co.uk or 020 7313 4800.

If you would like specifically to find out more about private medical insurance or other benefits you can contact ECIS at ecis@ecins.co.uk or visit www.ecins.co.uk.

Catherine Watt

Head of Employee Relations

Related Articles

HR implications of a Labour Government

Careers Week 2024: consider an electrotechnical career!

General Election 2024: Why a shortage of electrical apprentices matters

Electrician Plus: the future of competence in our sector

An appeal to industry from education

Empowering young people for World Skills Day 2023

Lean into local learning

Make 2023 your year for fire and security training

Tackling recruitment and retention challenges

The Construction Route – what needs to change?

Apprenticeships off to a positive start

We need diversity more than ever. Here are 5 ways we can get there

New Training Opportunities for EV Charge Point Installers

Don’t get taken for a ride by Rogue Trainers

Home Thoughts from Abroad: Skills Development

Home thoughts from abroad: Immigration

Home-thoughts from abroad: ‘What should they know of England who only England know?’

Back to the Future: Direct employment, the ‘gig’ economy and the lessons from history

IR35: the story behind the headlines

Looking back on 2020 with the JIB

Six reasons to hire apprentices

What’s the best way into the industry?

Why an operative-rating app leaves me feeling queasy…

Tackling unemployment post Covid-19

The importance of functional skills

Finding the best fit for your team? There’s an app for that

A Smart Career Move?

The future of furlough

IR35: essential steps to help you comply

Stopping the levy running dry

Do the maths, consider an electrotechnical career!

Opening the door to all

The Real Deal (At Last)?

Copyright © 2024 Electrical Contractors Association Ltd

.jpg?width=970&height=90&ext=.jpg)

.jpg?width=700&height=466&ext=.jpg)