“Broken lives and broken buildings”

.jpg?ext=.jpg)

As mental health makes its way to the top of many construction companies’ agendas, thanks to cross-industry initiatives such as Mates in Mind and Mind Matters, the links between slow and obstructive payment practices and poor mental health are beginning to surface.

A recent survey, aimed mainly at business owners, CEOs and managers, was run by ECA and BESA, in association with the Prompt Payment Directory and 25 other industry bodies. The survey received 613 responses in total, with 213 of these from business owners and sole traders.

Of these respondents, over nine in 10 respondents (92 per cent) said their business had faced payment issues and nearly two-thirds (65 per cent) said they were paid late frequently or very frequently.

The next Government must take immediate action on cash retentions and other payment abuse, by legislating for change

“Everybody expects business to deal with everyday pressures, but stress and other mental health impacts come from sustained and excessive pressure,” said Paul Reeve, ECA’s director of CSR. “It’s absolutely clear from these findings that poor payment is a serious cause of mental health issues across the industry and that the problem, far from being isolated to certain individuals, is commonplace among top management.”

Broken lives…

The survey showed that a remarkable nine out of 10 business owners across construction suffer an array of significant mental health problems due to the pressures of late or unfair payment, including stress, depression, extreme anger, anxiety and panic attacks.

Unfair payment practices also have a significant impact on employees right across a business, including directors, managers and other employees. Of all the respondents, four said they had attempted suicide as a result, while 80 per cent reported a mental health issue.

Furthermore, over four in 10 (41 per cent) of all respondents said that payment issues had strained their relationship with their partner, with five per cent reporting it caused it to breakdown entirely.

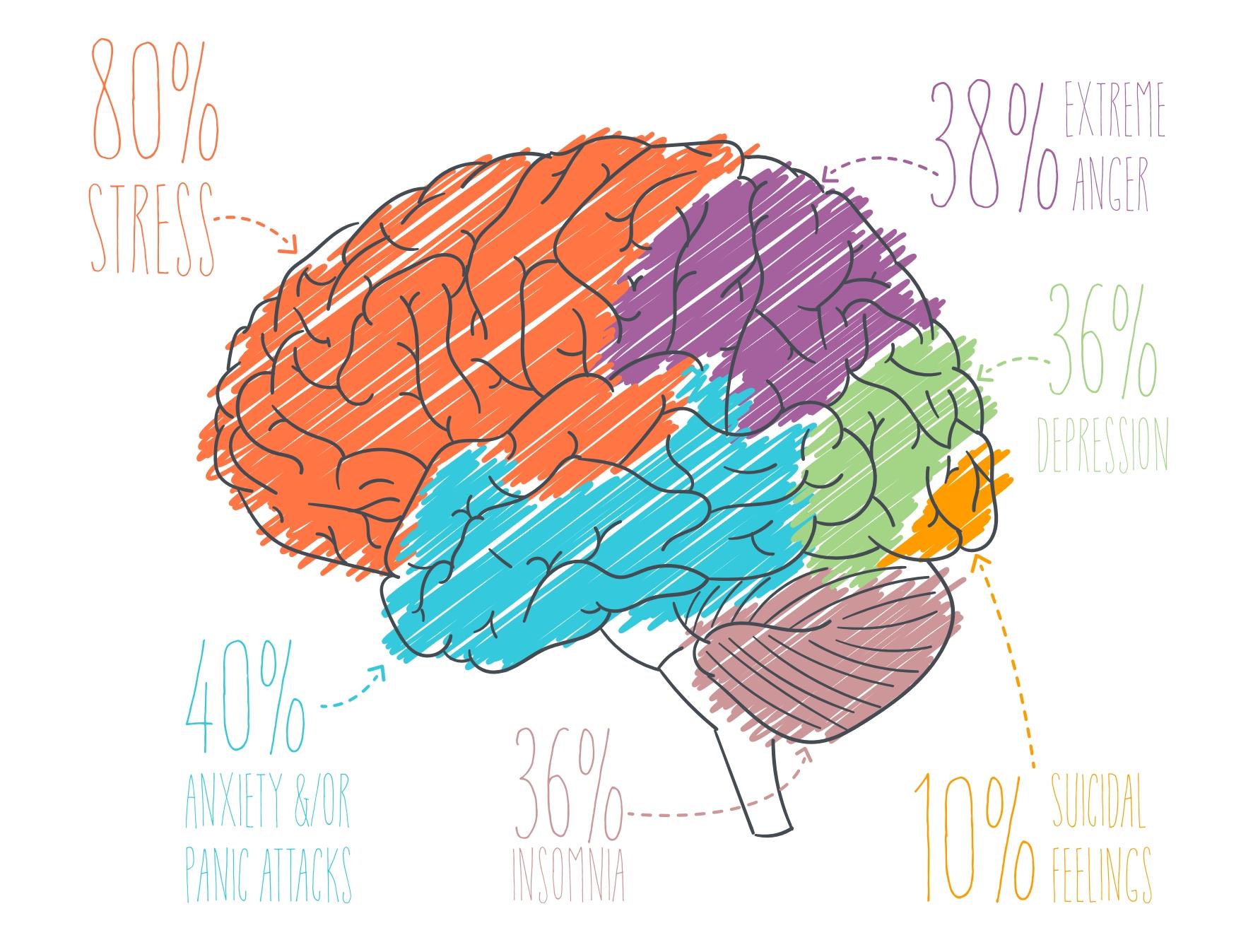

Mental health problems reported by survey respondents (note: respondents could select more than one answer)

Mental health problems reported by survey respondents (note: respondents could select more than one answer)

…Broken businesses

The survey also shed light on the concrete business impacts of late payment.

More than a quarter (27 per cent) of all survey respondents said that they had been, or had almost been, brought to the brink of bankruptcy or liquidation as a direct result of late payment.

The most common measure taken by business owners to cushion the blow of late payment to employees was to cut or stop their own pay for a period of time, with close to two thirds (60 per cent) having done so. A quarter (24 per cent) had delayed or cancelled staff social events, and more than 1 in 10 (14 per cent) had stopped or reduced staff perks such as company phones, cars or health insurance.

Alarmingly, almost 1 in 10 employers (7 per cent) were forced to pay their own staff late – an action which can have devastating effects on employees, who may then miss mortgage or rent payments as well as other vital overheads such as utilities and loan repayments.

Systemic payment abuse causes broken lives and even broken buildings, and it must be stamped out

“These problems quickly knock on to employees and families alike,” added Paul Reeve. “Findings such as these mean that clients and other buyers need to greatly improve their approach to supply chain payment and it’s a sad reflection on the industry that it will probably need legislation to achieve it.”

“Systemic payment abuse causes broken lives and even broken buildings, and it must be stamped out,” said BESA CEO David Frise. “The economic damage of these practices is well known but this survey has shed light onto its devastating human cost. Thousands of owners and workers of SMEs have struggled and suffered with this abuse for too long.”

The survey supporters are all part of a wider industry coalition pressing Government to reform the practice of cash retentions in construction. Cash retentions is widely considered to be one of the most unfair and abused payment practices across the industry.

What’s being done?

The BESA and ECA, along with other bodies, continue to push the issue of fair payment towards the top of the Government agenda. One example is the active support for Peter Aldous MP with drafting the Aldous Bill, a private members’ bill which aimed for the mandatory ring-fencing of cash retentions (money held back by larger contractors and clients from subcontractors if defects arise).

Some £7.8 billion of retentions money has gone unpaid for the last three years.

“The next Government must take immediate action on cash retentions and other payment abuse, by legislating for change,” said Rob Driscoll, ECA’s director of business. “Doing so will help to address the serious findings in this survey and actually help construction to achieve its dual aspiration of delivering excellence for clients and being an industry that’s attractive to new talent.”

Are you up to date with ECAtoday?

ECAtoday is the official online magazine of ECA and reaches thousands of people within the electrotechnical and engineering services industry.

.jpg?ext=.jpg)