IR35: the story behind the headlines

Andrew Eldred

Director of Workforce and Public Affairs, ECA

As the debate around self-employed tax changes (IR35) intensifies, we asked ECA’s Director of Employment and Skills, Andrew Eldred, to give us some background and tell us why ECA is championing direct employment.

What’s the issue?

There is a severe imbalance between direct employment and indirect employment. Indirect employment rates in the UK construction sector are typically three times higher than in France, and six times higher than in Germany.

Please explain the difference between direct and indirect employment.

Indirect employment is relying on workers supplied through agencies, intermediaries and various forms of self-employment. Direct employment is a permanent or fixed term job.

...the UK’s over-dependence on indirect employment is neither desirable nor sustainable

Why is ECA involved?

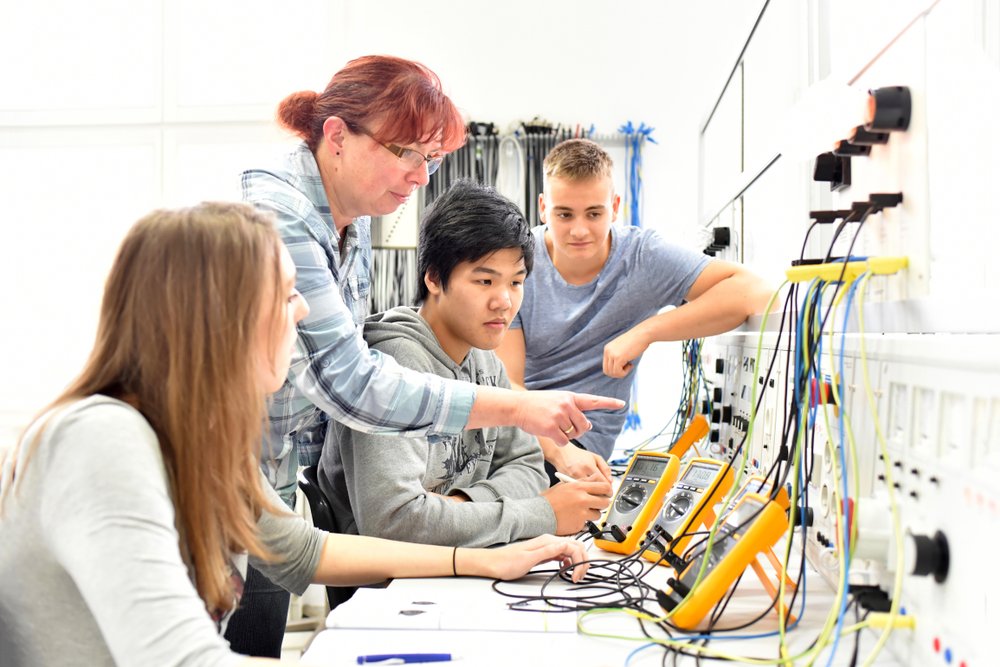

ECA and its Members recognise that the UK’s over-dependence on indirect employment is neither desirable nor sustainable. It undermines skills development, competence, quality, safety and wellbeing.

What has ECA been doing about direct employment?

Over the past year, ECA has used its voice within the Construction Leadership Council (CLC) to raise awareness about the issue among industry leaders and Government.

What has been the response?

We’ve had five very positive achievements:

- CLC’s June 2020 Roadmap to Recovery expressly recognised direct employment as an ‘enabler of apprenticeships, upskilling and competence’.

- Andy Mitchell CBE, CLC Co-Chair endorsed the Joint Industry Board’s report setting out the benefits of direct employment.

- Fergus Harradence of BEIS confirmed ‘this is going to be one of our objectives over the next few years; we will want to see more people directly employed.’

- The CLC Skills Recovery Plan, to be published next month, includes specific industry initiatives to raise levels of direct employment.

- We’ve also highlighted to Government how the current tax rules offer a major incentive to false self-employment.

What is ECA’s position on IR35?

ECA supports the tightening up of IR35 rules in the private sector. We know from experience that HMRC ‘crackdowns’ mean those who want to avoid the new rules will find other loopholes. We will therefore continue to press the CLC and Government to take a joined-up, all-encompassing approach to employment status, tax and employment rights as laid out in the Government’s own 2017 Good Work Plan.

When do the new tax rules come in?

Changes to IR35 take effect from 6th April 2021.

Andrew Eldred

Director of Workforce and Public Affairs, ECA

Before joining ECA, Andrew spent four-and-a-half years as Crossrail’s Head of Employee Relations. Prior to this he worked for the Olympic Delivery Authority’s delivery partner, and for several years in employee relations roles at the BESA and the Engineering Construction Industry Association.

Andrew is a member of the JIB National Board, director of Evolve (formerly Blue Sky) Pensions Ltd,. a trustee-director of the apprentice training charity JTL and a regular guest lecturer at Exeter University’s Business School.

Related Articles

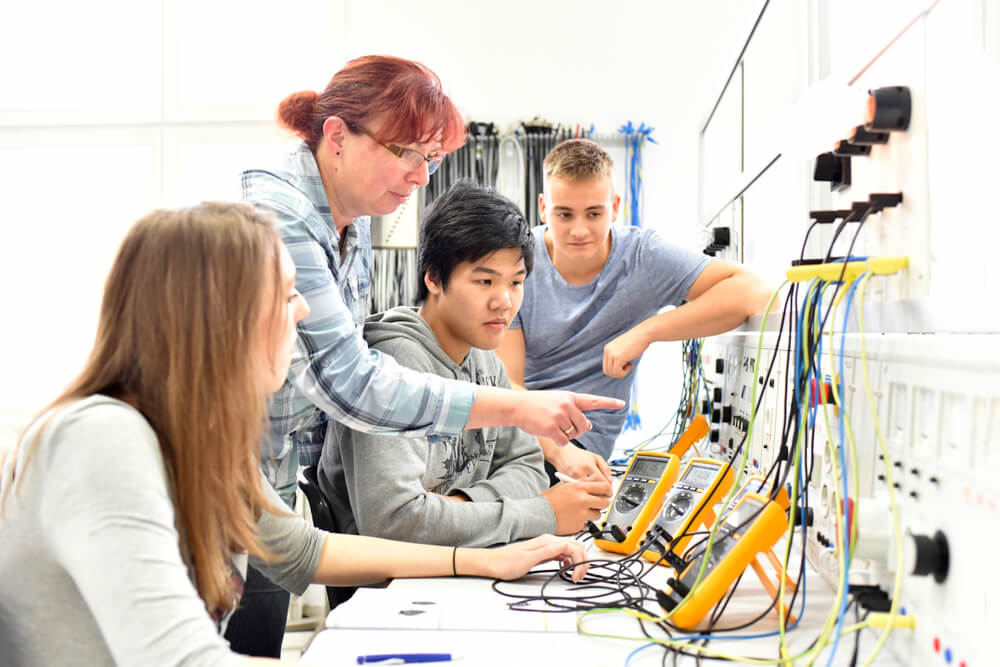

Careers Week 2024: consider an electrotechnical career!

General Election 2024: Why a shortage of electrical apprentices matters

Electrician Plus: the future of competence in our sector

An appeal to industry from education

Empowering young people for World Skills Day 2023

Lean into local learning

Make 2023 your year for fire and security training

Tackling recruitment and retention challenges

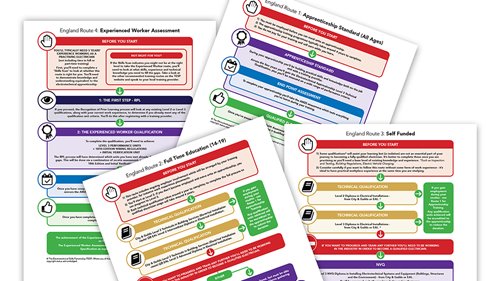

The Construction Route – what needs to change?

Apprenticeships off to a positive start

We need diversity more than ever. Here are 5 ways we can get there

New Training Opportunities for EV Charge Point Installers

Increasing Pay Pressures in Engineering Services

Don’t get taken for a ride by Rogue Trainers

Home Thoughts from Abroad: Skills Development

Home thoughts from abroad: Immigration

Home-thoughts from abroad: ‘What should they know of England who only England know?’

Back to the Future: Direct employment, the ‘gig’ economy and the lessons from history

Looking back on 2020 with the JIB

Six reasons to hire apprentices

What’s the best way into the industry?

Why an operative-rating app leaves me feeling queasy…

Tackling unemployment post Covid-19

The importance of functional skills

Finding the best fit for your team? There’s an app for that

A Smart Career Move?

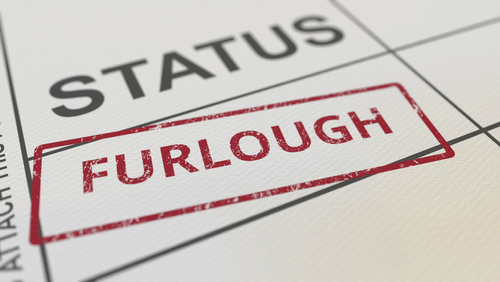

The future of furlough

IR35: essential steps to help you comply

Stopping the levy running dry

Do the maths, consider an electrotechnical career!

Opening the door to all

The Real Deal (At Last)?

Are you up to date with ECAtoday?

ECAtoday is the official online magazine of ECA and reaches thousands of people within the electrotechnical and engineering services industry.

Copyright © 2024 Electrical Contractors Association Ltd

.png?width=970&height=90&ext=.png)

.jpg?width=700&height=466&ext=.jpg)